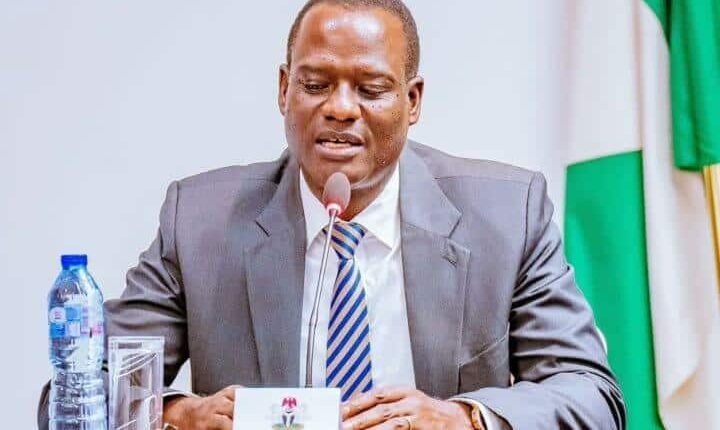

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has reassured the Nigeria Labour Congress (NLC) that the proposed Tax Reform Bill will significantly improve the welfare of Nigerian workers.

The NLC had earlier raised concerns about the bill and requested its withdrawal from the National Assembly to allow for further consultations. Responding to these concerns, Oyedele took to X (formerly Twitter) on Thursday to address the matter, highlighting the worker-friendly provisions of the bill.

“We welcome the interest of the Nigeria Labour Congress (NLC) on the Tax Reform Bills and note their concerns about the potential impact on workers’ welfare,” Oyedele stated.

He emphasized that workers earning less than ₦1 million annually (approximately ₦83,000 monthly) would enjoy full tax exemptions.

Key Provisions of the Tax Reform Bill for Workers:

- Full Tax Exemption: Workers earning up to ₦1 million annually will be exempt from PAYE tax, benefiting roughly one-third of private and public sector employees.

- Reduced Taxes: Employees earning up to ₦20 million annually (approximately ₦1.7 million monthly) will benefit from reduced PAYE taxes, covering an additional 60% of workers.

- Special Exemptions: Members of the armed forces actively fighting insecurity will be exempt from PAYE taxes, alongside other ranks.

Oyedele described the bill as the most pro-worker tax reform in Nigeria’s history and urged the NLC to support its implementation.

“While we acknowledge the need for further improvement through robust debate and engagement, this legislative process offers a historic opportunity to prioritize workers’ welfare,” he said.

The proposed reforms aim to enhance disposable income for workers and address long-standing tax inequities, offering a comprehensive framework for economic improvement.

Comments are closed.